Robustness of Affine Short Rate Models

David Mandel — Florida State University — Department of Mathematics

Feb 25, 2016

Overview

- Global Sensitivity Analysis

- Calibration of Vasicek & CIR Models

- Robustness Results

Methods

- ANOVA Decomposition

- Monte Carlo

- Maximum Likelihood Estimation (MLE)

- Asymptotic Distribution Approximations of MLEs

Robustness

- The ability of tolerating perturbations that might affect the system's functional body.

- System = bond prices implied by interest rate model, perturbations = changes in parameter values.

- Global sensitivity analysis (GSA) to quantify sensitivity to parameters.

Global Sensitivity Analysis

ANOVA Decomposition

For $f \in \mathcal{L}^2[0,1]^d$ and $D := \{1,2,\ldots,d\}$,

$\displaystyle f(x) = \sum_{u \subseteq D} f_u(x_u), \qquad (f_u, f_v) = 0, \, u \neq v$

$\displaystyle \boxed{\sigma^2 = \sum_{u \subseteq D} \sigma_u^2}$

ANOVA Decomposition

$\displaystyle \boxed{\sigma^2 = \sum_{u \subseteq D} \sigma_u^2}$

"First-order effects" $\displaystyle \underline{S}_u := \frac{1}{\sigma^2} \sum_{v \subseteq u} \sigma^2_v$

"Total effects" $\displaystyle \bar{S}_u := \frac{1}{\sigma^2} \sum_{v \cap u \neq \emptyset} \sigma^2_v$

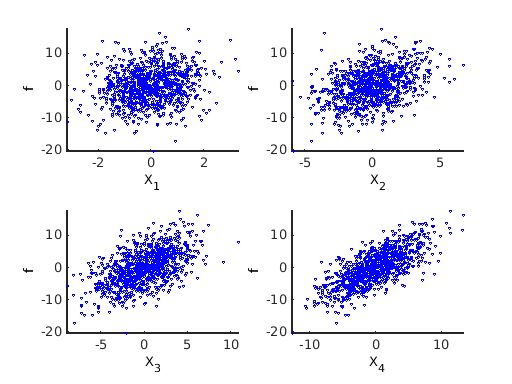

Global Sensitivity Analysis

| $\underline{S}_{\{1\}}$ | $\underline{S}_{\{2\}}$ | $\underline{S}_{\{3\}}$ | $\underline{S}_{\{4\}}$ |

|---|---|---|---|

| $0.0331$ | $0.1334$ | $0.2996$ | $0.5331$ |

First-Order Effects

| $\underline{S}_{\{1\}}$ | $\underline{S}_{\{2\}}$ | $\underline{S}_{\{3\}}$ | $\underline{S}_{\{4\}}$ |

|---|---|---|---|

| $0.0331$ | $0.1334$ | $0.2996$ | $0.5331$ |

$\underline{S}_{\{i\}}$ measures the expected fraction of variance to be eliminated if the "true" $X_i$ were known.

Total Effects

- $\bar{S}_{\{i\}}$ takes the first-order effects and all interactions of $X_i$ into account

- If $\bar{S}_{\{i\}} \approx 0$, parameter $i$ has negligible effect - can freeze

- Offers insights into model reduction

Maximum Likelihood Estimation

Maximum Likelihood Estimation

- Assume $X \sim P_\theta$ with joint pdf $f(x; \theta)$, $\theta \in \Theta$

- Likelihood function $$ L(\hat{\theta}_n) := \sup\limits_{\theta \in \Theta} f(x;\theta) $$

- Convergence in distribution $$ \sqrt{n}(\hat{\theta}_n - \theta) \xrightarrow d \mathcal{N}(0,I^{-1}(\theta)) $$

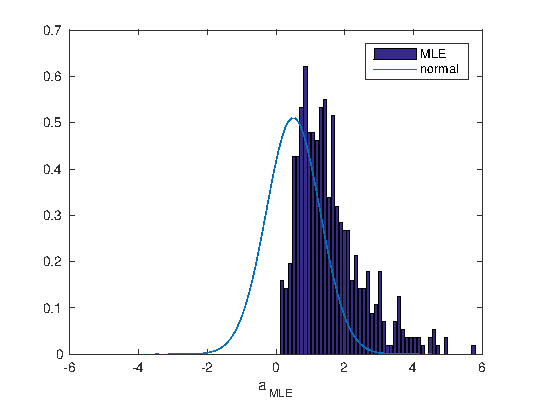

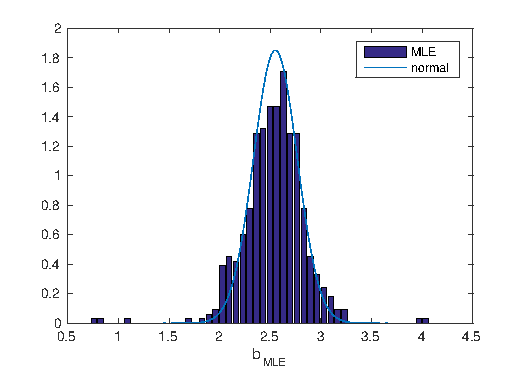

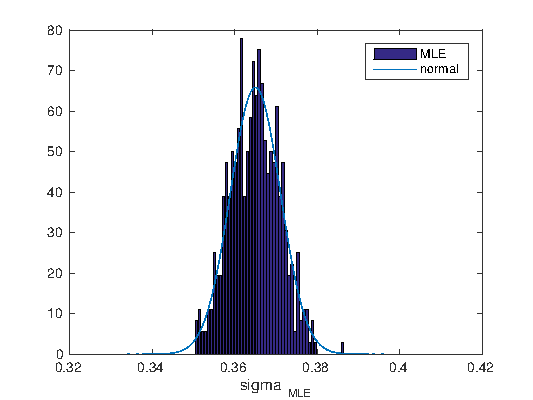

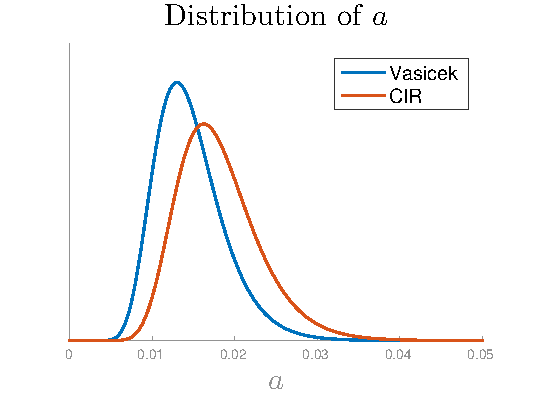

Example - Vasicek Model

- $Q$-dynamics $$ dr_t = a(b - r_t)dt + \sigma dW_t $$

- Implies normal distribution of short rate: $$ r_t \mid r_0 \sim \mathcal{N}\left(r_0e^{-at} + b\left(1 - e^{-at}\right), \frac{\sigma^2}{2b}\left(1 - e^{-2at}\right)\right) $$

- Parameters to be calibrated:

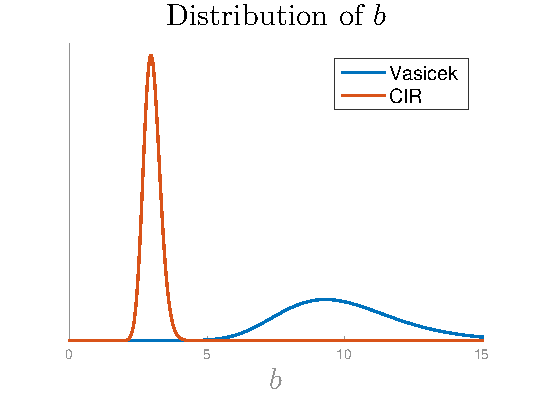

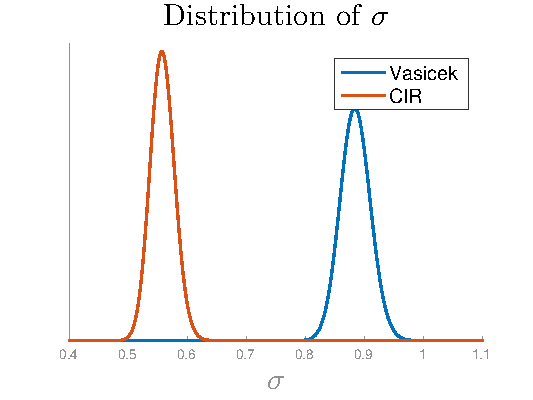

- $a > 0$ = mean reversion speed

- $b > 0$ = long-term mean

- $\sigma > 0$ = volatility

- 2 issues: asymptotic normality and observable data

Vasicek Calibration - Normality

Vasicek Calibration

- Calibrate logarithm of parameters, instead

- Lognormal distribution implied by MLE theory

- Short rate not observable; yields are observable

- Calibration performed to four years of Treasury yields, maturities 1-30 years

- Now have (approximate) distributions of parameters

CIR Model - Same Idea

- $Q$-dynamics $$ dr_t = a(b - r_t)dt + \sigma \sqrt{r_t}dW_t $$

- Implies a noncentral chi-squared distribution of the short rate

- Parameters to be calibrated:

- $a > 0$ = mean reversion speed

- $b > 0$ = long-term mean

- $\sigma > 0$ = volatility

Parameter Distributions

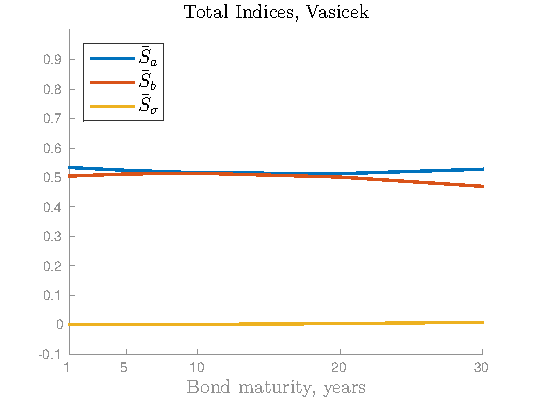

Robustness Results

Closed-Form Bond Price Models

$$ P(t,T) = e^{A(t,T;a,b,\sigma) + B(t,T;a,b,\sigma)r_t}$$

Robustness

- The ability of tolerating perturbations that might affect the system's functional body.

- System = bond prices implies by interest rate model, perturbations = changes in parameter values.

- Global sensitivity analysis (GSA) to quantify sensitivity to parameters.

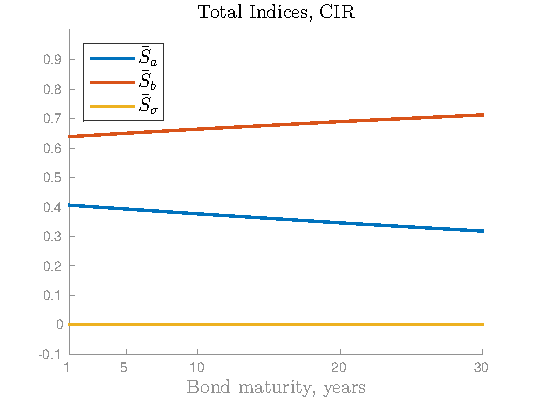

Sensitivities as Functions of Maturity

Robustness

- The ability of tolerating perturbations that might affect the system's functional body.

- System = bond prices implied by interest rate model, perturbations = changes in parameter values.

- Global sensitivity analysis (GSA) to quantify sensitivity to parameters.

- MLE-implied parameter distributions don't capture total uncertainty in parameters

- Additional uncertainty because of truncating asymptotic result and model fit error

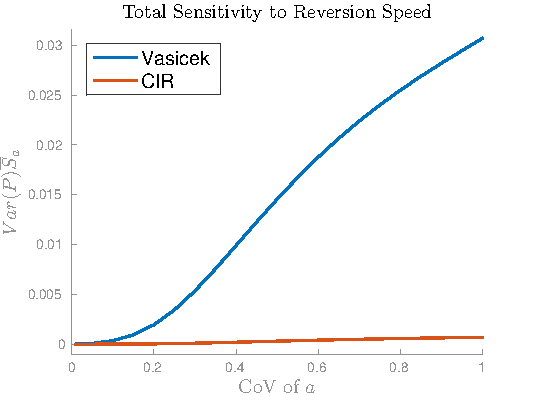

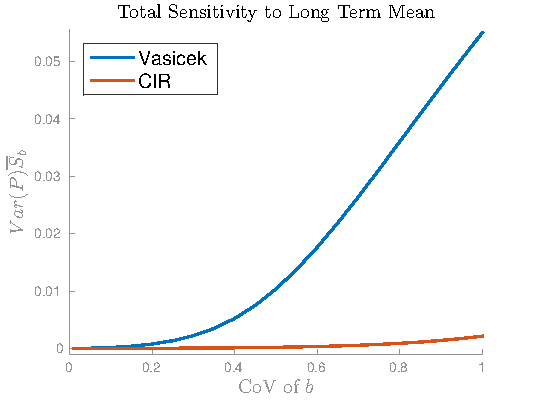

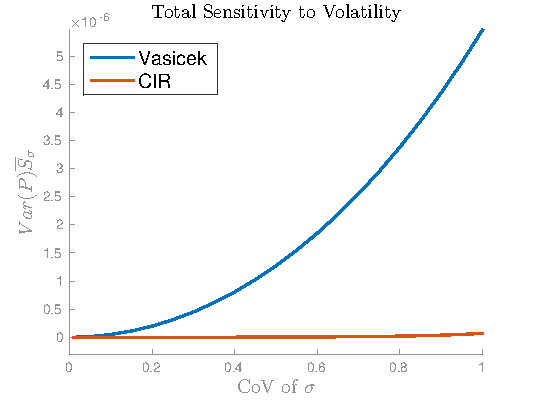

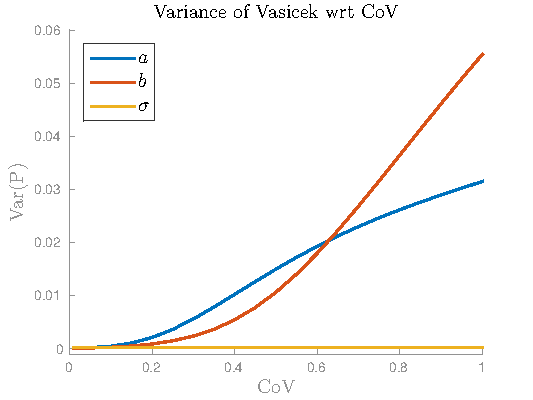

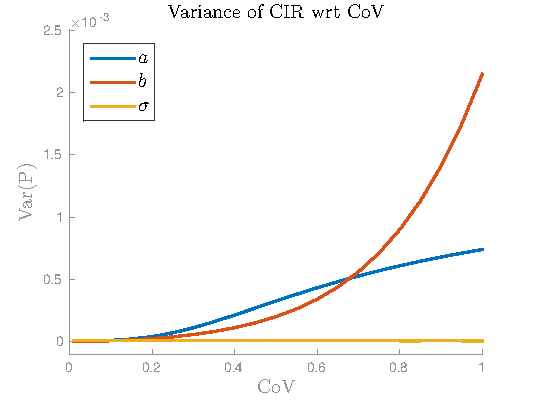

Sensitivities as Functions of Parameter Uncertainty

Model Variances as Functions of Parameter Uncertainty

Conclusions and Future Work

- CIR more robust than Vasicek

- Narrow in scope - depends on calibration method and data

- Dependence of parameters - ANOVA assumes independence

- Formulate sensitivity indices so uncertainty in parameters is input